The Best Guide To Best Personal Loans

Wiki Article

The 10-Second Trick For $100 Loan Instant App

Table of ContentsHow Loan Apps can Save You Time, Stress, and Money.Some Known Questions About Best Personal Loans.Some Of Best Personal LoansThe Only Guide to Best Personal LoansRumored Buzz on Loan AppsThe 9-Minute Rule for Instant Cash Advance App

When we think of making an application for car loans, the imagery that comes to mind is people lining up in lines up, waiting for countless follow-ups, and obtaining entirely aggravated. However innovation, as we understand it, has actually altered the face of the financing service. In today's economic situation, borrowers and not lending institutions hold the trick.Funding authorization as well as documents to funding processing, every little thing is online. The several trusted online financing apps offer consumers a platform to make an application for loans quickly as well as provide approval in mins. You can take an from some of the finest cash finance apps readily available for download on Google Play Store as well as App Shop.

You just have to download and install the app or go to the Pay, Sense site, authorize up, publish the needed papers, and your lending will certainly obtain approved. You will get notified when your funding demand is processed.

The Only Guide to Instant Cash Advance App

Frequently, also after obtaining your loan approved, the procedure of getting the financing quantity transferred to you can require time as well as obtain made complex. However that is not the case with online finance apps that supply a direct transfer choice. Instantaneous financing apps provide instant individual car loans in the variety of Rs.

5,00,000 - instant loan. You can get an immediate car loan based on your qualification as well as require from instantaneous financing applications. So, you do not have to worry the next time you wish to make use a small-ticket finance as you understand exactly how valuable it is to take a car loan using online lending apps. So, do away with the time-consuming and tiring procedure of use typical personal car loans.

The 45-Second Trick For Instant Loan

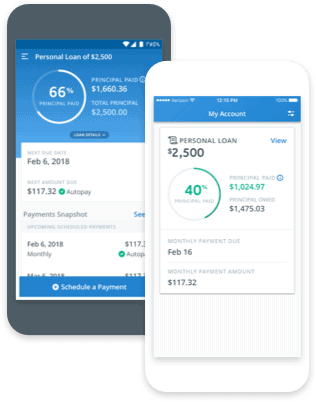

By digitizing as well as automating the lending procedure, the platform is transforming typical financial institutions right into digital lenders. In this short article, let's explore the benefits that a digital lending platform can bring to the table: what's in it for both financial institutions and their consumers, and just how electronic lending platforms are interrupting the sector.They can also check the bank statements for info within only secs. These attributes aid to make sure a fast and also convenient individual experience. The digital financial landscape is now a lot more vibrant than ever before. Every financial institution now desires every little thing, including lendings, to be refined instantly Full Article in real-time. Customers are no longer ready to await days - as well as to leave their residences - for a lending.

Rumored Buzz on Loan Apps

All of their everyday activities, consisting of economic purchases for all their tasks and they choose doing their financial transactions on it as well. They desire the convenience of making transactions or using for a you can try these out lending anytime from anywhere - best personal loans.In this situation, digital loaning platforms act as a one-stop solution with little hands-on information input as well as fast turn-around time from funding application to money in the account. Customers must be able to relocate flawlessly from one gadget to another to finish the application kinds, be it the web and mobile user interfaces.

Companies of digital borrowing systems are called for to make their products in compliance with these laws and also aid the lending institutions concentrate on their business only. Lenders likewise must see to it that the providers are updated with all the most recent guidelines issued by the Regulatory authorities to quickly integrate them right into the digital borrowing system.

See This Report about Instant Loan

As time passes, electronic borrowing systems can conserve 30 to 50% overhead costs. The standard hands-on borrowing system was a pain for both lending institution as well as consumer. It relies upon human treatment as well as physical interaction at every step. Clients had to make several trips to the financial institutions and also send all sort of documents, as well as manually submit numerous types.The Digital Lending system has transformed the way financial institutions consider as well as execute their loan purchase. Financial institutions can currently deploy a fully-digital funding cycle leveraging the most up to date innovations. A fantastic electronic loaning system have to have easy application submission, quick authorizations, compliant loaning procedures, and the capability to consistently click resources boost procedure efficiency.

Consumers will certainly need to count on non-bank sources of funding." It is necessary to note that lending is a really lucrative fintech market, where 28% of the leading 50 fintech companies operate. If you're assuming of going right into loaning, these are reassuring numbers. At its core, fintech is everything about making typical financial processes much faster as well as a lot more reliable.

Unknown Facts About Instant Cash Advance App

One of the usual false impressions is that fintech apps just benefit monetary establishments. The application of fintech is now spilling from banks and also loan providers to small organizations. instant loan., Chief executive officer of the payment system Veem, amounts it finest: "Little companies are looking to contract out intricacy to somebody else because they have enough to fret about.As you can see, the simplicity of usage tops the list, revealing just how availability as well as benefit supplied by fintech platforms stand for a massive motorist for customer loyalty. You can use many fintech developments to drive customer trust as well as retention for businesses.

Report this wiki page